About Headway

Why benefits and insurance verification are so complicated — and how Headway helps

Learn more about how Headway is investing in smarter insurance verification, so you can focus on care.

September 12, 2025

4 min read

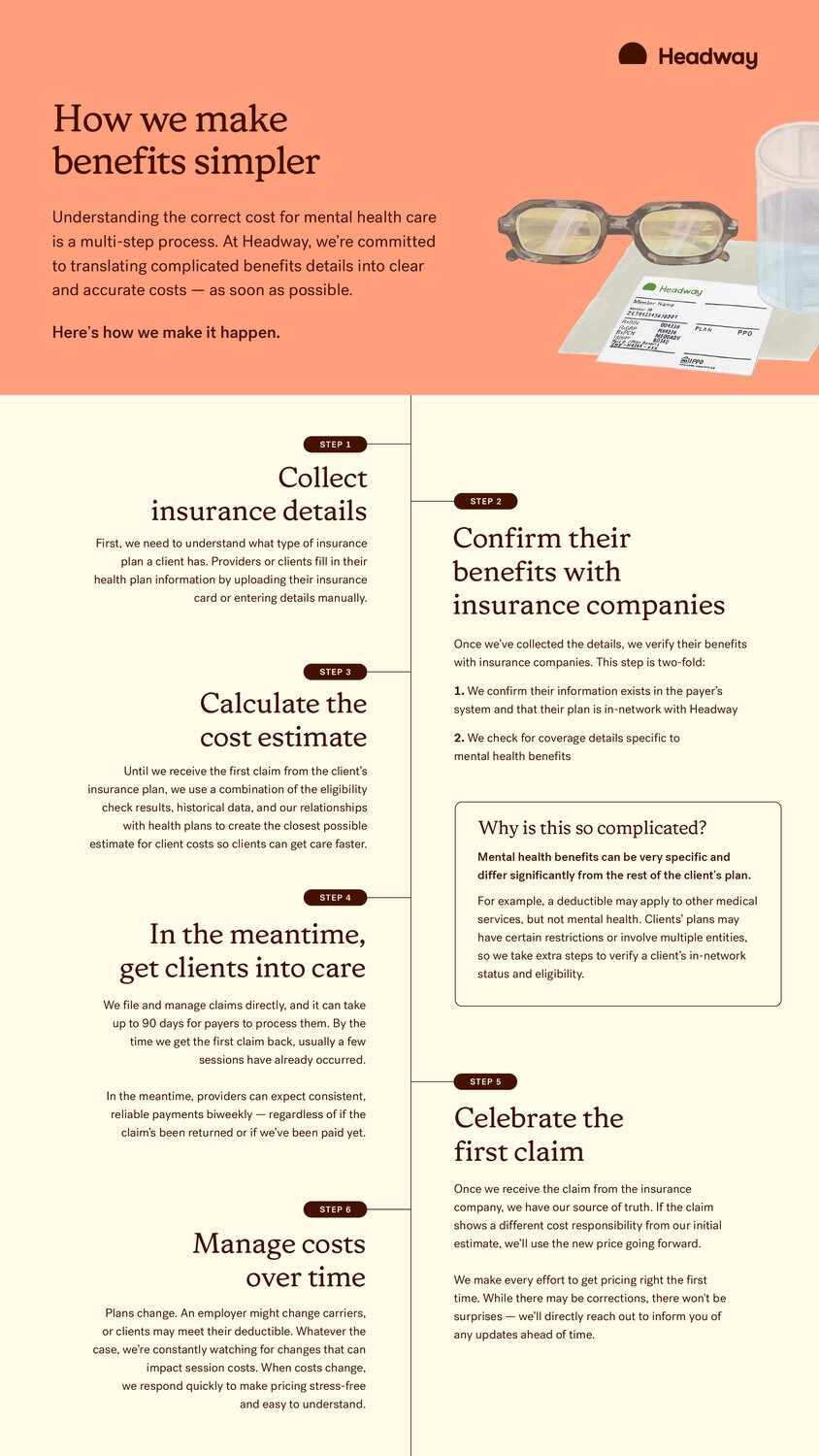

As your practice partner, we want you to be able to focus on your clients, not deciphering the complexities of insurance. Yet, the question you and your clients face daily — ”How much will this cost? ”— can feel nearly impossible to answer.

You shouldn’t have to become an insurance expert to run your practice. At Headway, our goal is simple: untangle the business of insurance so you can focus on delivering care.

Today, we’ll pull back the curtain on patient insurance verification, including why this process is so complicated and, most importantly, how Headway is investing heavily in making it simpler and more predictable for you and your clients.

Practice in-network with confidence

Simplify insurance and save time on your entire workflow — from compliance and billing to credentialing and admin.

The daily challenge: How insurance verification works

On the surface, figuring out a client’s benefits sounds simple: Will they owe a $25 copay, a 20 percent coinsurance after a deductible, or nothing at all?

In practice, it’s rarely that clear. Mental health coverage is layered in exceptions and shifting requirements, so what looks like a quick calculation often unravels into a messy process.

As a provider, you’re familiar with how benefits can cause confusion — and when your clients come to you for explanations, you know the journey to deducing costs is rarely a straight line.

What makes benefits so complex

At first glance, benefits can appear straightforward, but mental health coverage comes with its own rules and exceptions — and they don’t always match what you’d expect from medical coverage. Determining benefits is not as straightforward as looking up a member ID. The reality is mental health benefits are unique, often walled off from other, general medical coverage with their own specific rules.

Here’s some of the complexity we navigate on you and your clients’ behalf:

- Third-party plans: Some plans may be administered by a third-party, which means a smaller insurance company uses a larger “parent” network for mental health benefits. In these cases, we need to take extra steps to validate their in-network status and make sure claims are routed to the right “parent” plan.

- Tracking deductibles: A client’s deductible is a moving target. Medical appointments, prescriptions, and lab work can all apply, but Headway only has visibility into the mental health claims filed on our platform and the progress an insurer shares with us. Knowing precisely when a client has met their deductible — and when their costs should drop — requires constant monitoring and communication with payers.

- Eligibility requirements: A client’s plan might cover talk therapy, but have different cost-sharing for medication management. Some plans may have session limits or have different benefits for telehealth or in-person telehealth sessions.

- Ever-changing plans: Coverage isn’t static. A client may switch plans during open enrollment, or their employer might change carriers. Each change resets the verification process and can alter their out-of-pocket costs unexpectedly.

And that’s just scratching the surface. Plan type, coverage dates, Medicaid or Medicare affiliation, individual vs. family deductibles — each adds another layer of complexity. Even two clients with the same insurer can end up with very different costs — and two representatives from an insurance company may give us different information.

When it comes to providing the best possible care to your clients — and improving efficiency in your practice — insurance verification is an essential piece of the puzzle. Verifying benefits prevents billing errors, maintains organizational efficiency, helps you and your client avoid surprises, and ultimately prioritizes client-focused care.

If this feels overwhelming, you’re not alone. The truth is, the system wasn’t built with simplicity in mind. That’s why we’re investing in tools to make it easier for you and for your clients.

Complex problems demand sophisticated solutions

Making insurance predictable takes more than good intentions — it takes real investment. That’s why this isn’t a side project for Headway, it’s a core focus.

We’ve dedicated a team of engineers, data analysts, product managers, and insurance operations specialists to one shared goal: delivering accurate and timely cost estimates to you and your clients.

Here’s how we’re turning that investment into tangible results for our practice:

1. From reactive fixes to proactive predictions

In the past, insurance systems only revealed problems after the claim was denied. That’s too late — it leaves you and your clients caught off guard.

We’re changing that by developing systems that prevent denials and anticipate cost inaccuracies before they happen, so clients can confidently commit to affordable care faster versus waiting to learn about their coverage. Here’s how:

- Our teams pour over historical, anonymized claims data, looking for patterns in how different insurance plans behave.

- By feeding this data into our estimation models, we improved the accuracy of our initial cost estimates by 5 percent.

- While 5 percent may sound modest, it translates to thousands more clients starting therapy with a clear and correct understanding of their costs, which prevents billing surprises down the road.

2. Faster, more frequent benefits updates

Even the most accurate estimate is only as good as the latest information. That’s why we’ve built systems to refresh benefits more often and flag changes quickly, so we’re catching updates faster than before.

When answers are hard to come by, our team doesn’t just wait for answers — we pick up the phone and push for clarity on your behalf.

3. Building for the future: the road to wildly predictable insurance

Catching errors quickly is important, but our vision goes further. We want to make costs not just accurate today, but predictable tomorrow.

That means moving beyond reacting to plan changes and instead modeling a client’s journey, so you and your clients can see what’s coming. Clearer costs help clients commit to care with more confidence.

At the heart of the matter, it’s not just about correcting issues faster — it’s about proactively anticipating milestones or transitions before it becomes a point of confusion.

Our vision for wildly predictable insurance is not just about having the data; it’s about making it clear and actionable for your clients. This means communicating next steps early. We’re making investments in giving you more visibility into the status of your clients’ claims and their billing history, all intuitively in your portal — so that when a cost changes, not only are your clients informed and prepared, but so are you.

By building a smarter, more predictable insurance verification process, we can offer the peace of mind that comes from knowing your clients are in good hands, whether that’s in your sessions or in their claims and billing management afterwards.

Practice in-network with confidence

Simplify insurance and save time on your entire workflow — from compliance and billing to credentialing and admin.

This content is for general informational and educational purposes only and does not constitute clinical, legal, financial, or professional advice. All decisions should be made at the discretion of the individual or organization, in consultation with qualified clinical, legal, or other appropriate professionals.

© 2025 Therapymatch, Inc. dba Headway. All rights reserved. No part of this publication may be reproduced without permission.

About Headway

Where Headway’s earnings come from (and where they go)

Our vast network of providers like you makes it possible to secure better rates for everyone — without charging to use our platform.

10 therapists share their honest thoughts on Headway

Headway helps simplify insurance for more than 80,000 mental health care providers across the country.

Getting started with Headway in 30 days

If the journey of one thousand miles begins with a single step, then the journey to starting or streamlining your insurance practice begins with a single call.